Chief UK economist warns of period of stagnation – How will this affect your SME?

Stagnation is a prolonged period of little or no growth in the economy and it can have a serious impact […]

Could you enjoy a slice of the £1.6bn creative industry tax reliefs?

If your company is involved in the creative industry, then it could be eligible for significant tax relief from the […]

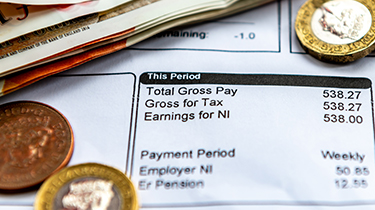

Three tips for managing maternity and paternity pay for small businesses

As experts in the field of accountancy, we understand the unique challenges business owners face when it comes to payroll. […]

New R&D supplementary information form in effect

As of 8 August 2023, all Research and Development (R&D) Tax Credit claims require the submission of an online Additional […]

£56 million overpaid in pension tax

In the second quarter of 2023, overpayments on pension tax in the UK reached £56 million. This was an increase […]

The benefits of Employee Ownership Trusts

Introduced in 2014, Employee Ownership Trusts (EOTs) provide an attractive alternative to traditional business succession strategies, offering a series of […]

Eight ways your accountant can boost the success of your business

Accountants are often seen as guardians of tax and compliance. However, their expertise extends far beyond these areas. They can […]

What you need to know about the High-Income Child Benefit charge and the upcoming changes

The High-Income Child Benefit Charge (HICBC) is a tax that affects households where at least one person with parental responsibility […]

Why companies fail to pay the National Minimum Wage and how to avoid the same mistakes

The Government recently named over 200 companies for failing to pay the national minimum wage (NMW). The list includes firms […]

Time to exit: New research shows many business owners are planning ahead

New research from wealth management firm Evelyn Partners has revealed that the majority of business owners with companies that earn […]