Why companies fail to pay the National Minimum Wage and how to avoid the same mistakes

The Government recently named over 200 companies for failing to pay the national minimum wage (NMW). The list includes firms […]

Time to exit: New research shows many business owners are planning ahead

New research from wealth management firm Evelyn Partners has revealed that the majority of business owners with companies that earn […]

Are banks supportive of SMEs and willing to assist their growth?

Small and medium-sized businesses (SMEs) have struggled to access finance from banks for a while, with many having to turn […]

HMRC sets its sights on SMEs over UK tax gap

The tax gap in the UK – the difference between the amount of tax owed and the amount that has […]

The hidden economy: What income should you declare?

The number of individuals participating in the UK’s ‘hidden economy’ is increasing according to recent research. A surge in additional […]

Management accounts: The importance of having a clear view of your business during uncertain times

In times of economic uncertainty, businesses should have a clear plan to ensure that they can navigate any potential financial […]

Inflation and increased interest rates – What does it mean for businesses?

Office for National Statistics (ONS) data revealed that the Consumer Price Index (CPI) – the official measure of inflation – […]

The ins and outs of pre-notification of R&D claims

The UK Government has long encouraged businesses to invest in Research & Development (R&D) projects, believing it to be at […]

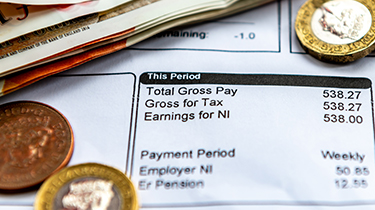

Constantly asked for pay rises? Here is what you need to know about pay in the UK

As an employer, you will likely face the delicate situation of employees asking for pay rises. With the cost-of-living crisis […]

Changes to free childcare, but higher earners will still miss out

In the Spring 2023 Budget, the Government laid out plans to shake up the current free childcare system – but […]